US$2.1 million – the average amount companies spend annually vetting their third-parties, yet only 51% of surveyed companies employ risk scanning tools. Worse, 54% state these results are only somewhat valuable or don’t provide any insights at all (Security Boulevard, 2021). More than 80% of legal and compliance leaders told Gartner that third-party risks were identified after the initial onboarding and due diligence, suggesting traditional due diligence methods in risk management policy fail to capture new and evolving risks (Gartner, 2021).

World’s largest automotive safety supplier introduces AuditComply to simplify a complex supplier network

The customer recognized the need to unify and consolidate their Audit, Quality and Supply Chain management functions. Requiring an agile platform that could assess thousands of global suppliers in real-time.

Clearly, the above statistics illustrate why third-party risk management is rapidly becoming a first priority challenge. One in two companies now believe the cost of a third-party risk incident–such as a supply chain failure, data privacy breach or disruption to IT services–has at least doubled in the past five years (2015-2020), with failures costing companies as much as US$1 billion per incident (Deloitte, 2020). From suppliers to software vendors, we are increasingly relying on external sources to increase our margins. However, this advantage can be taken away from us just as quickly if we do not have appropriate oversight of third-party threats.

Commonly Identified Third-Party Risks

While the risk landscape continues to evolve and new threats emerge, third-party risk commonly falls into one of the four categories below:

Operational: Risk that poses a threat to operations resulting from failed processes, people, systems or external events. For example, a natural disaster. The earthquake and tsunami in Japan in 2011 wreaked havoc on global supply chains. Caterpillar, the world’s largest manufacturer of earthmoving equipment by revenues, said its factories around the world were ‘sporadically impacted’, costing them $US300m in sales and US$100m in operating profit.

Financial & Reputational: Risk that a third-party could damage your revenue or reputation. For example, COVID-19 caused a surge in electronic device sales, resulting in a global chip shortage. Ford is expecting to lose up to half of its planned production in the second quarter of 2021, while General Motors has stated that losses caused by the lack of semiconductors could cost up to US$2 billion in profit.

Legal & Regulatory: Risk that a third-party will impact your compliance with legislation or regulation. For example, if your supplier violates environmental legislation it’s likely your company will be made liable. Learn more about managing ESG risk across your supply chain here.

Digital: Risk that a third-party could be hacked or breached causing the loss of critical assets or sensitive information. For example, the Colonial Pipeline ransomware attack. The government outsourced its energy operations to a private company, relying on the Colonial Pipeline to protect it. The Colonial Pipeline attack exposed the government’s reliance on third parties to manage its operations of critical infrastructure.

Adopting a New Approach to Third-Party Risk Management

The question remains, how should you proceed? Introduce a dedicated Risk & Audit Management platform to monitor third-parties. This will rapidly improve your operating efficiency, reduce costs, allow you to be flexible to changes in the internal and external environment and boost overall risk oversight. Your network of third-party relationships is an important strategic advantage that’s unique to your company but only if risk and supply chain leaders have real-time oversight. As a result of the above, as a Third-Party Risk Management customer you require a solution that can provide:

An effective supplier onboarding & engagement process: Quickly establish if your third-party is safe to do business with by remotely assessing, communicating, interrogating and managing documentation/ insurance or regulatory certificates, in one centralized third-party portal; categorizing each third-party by their determined risk profile or potential impact of failure.

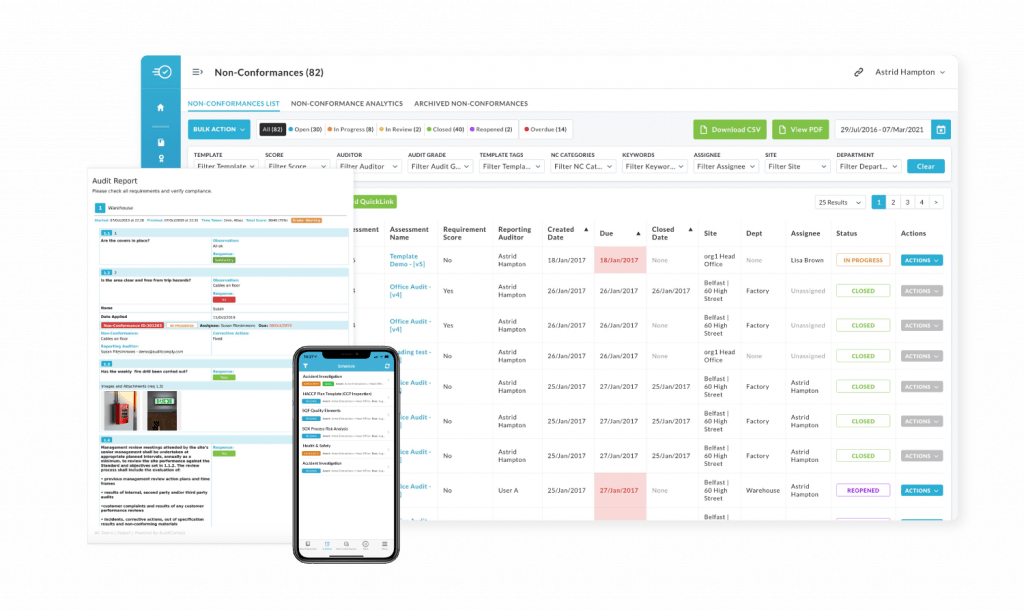

Constant surveillance & support throughout the relationship lifecycle: Ensure each third-party has a dedicated management portal to optimize issue/non-compliance identification and mitigation, ongoing communications, real-time analytics & scheduled reporting.

Leverages actionable insights to contextualize analysis: Develop standardized processes and proactive decision making using real-time analytics. Allowing you to find clarity when you need it most.

Aligns third-party risks with business strategy and resilience: Move from having no formal governance over third-parties to a more intelligent risk-based approach that is better aligned with your strategy.

Protect Your Revenue, Reputation and Resilience with AuditComply’s Third-Party Risk Management Platform

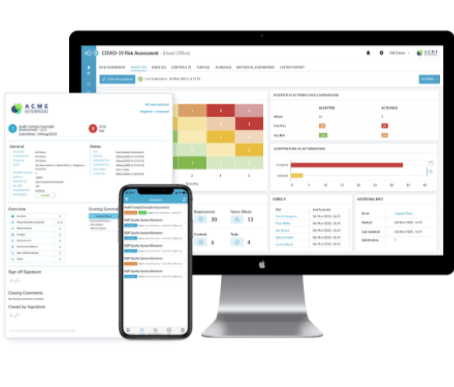

AuditComply’s dedicated third-party management platform will help connect the dots of an originally fragmented and disconnected process, helping reduce that uncertainty and complexity from the beginning. By taking advantage of our asset manager capabilities, assessment template builders, risk hubs, configurable workflows and in-house advisory team, you can expect to effectively manage, monitor and track multiple stages of your external relationships. Making AuditComply the solution of choice.

Why Wait For Tomorrow?

Find out how AuditComply can guide & evolve your third-party risk management program today, request a demo here.

Report By Risk, Assess By Audit

AuditComply is an Integrated Risk Management (IRM) platform, revolutionizing the way enterprises assess, track, action and report on risk, compliance and quality processes in real time. Defining the next generation of GRC, AuditComply empowers enterprises to mitigate risk, drive compliance and improve quality within the industry’s most innovative and user-friendly assessment platform.